Difference Between Gambling And Investment

The argument basically maintains that the difference between investment and gambling is the fact (and it is, admittedly, a fact) that a smart investor acting on the best possible information has a significant “edge” over the gambler. That’s not a distinction between gambling and investing, though. . Gambling is more of a recreational activity. Investing is a serious activity that involves research and background knowledge. More than in investment, there is a higher risk in gambling. Gambling is commonly found in casinos while investing is done in establishments such as banks and businesses.

[Welcome to the fifth installment of our gambling/investing series. Just in case you missed them, you can still read Part One, Part Two, Part Three and Part Four]

One difference is that investing promotes production and manufacturing and beneficial products for Ummah and creates useful job which results in many benefits for having a healthy society. But gambling has no beneficial product. Without investing many of factories and industries will never start working.

- Jun 18, 2008 Can you explain the difference between gambling and investing? Thanks in advance. Thank you for your e-mail and question about the differences between gambling and investing. There are a number of Christian authors who have addressed this. There is often some confusion between the terms investment, speculation and gambling.

- One of the key differences between investing and gambling is diversification. Investing provides you with the opportunity to spread your risk across all asset classes, whereas gamblers throw their capital into a single pot with no loss mitigation strategy.

Let’s look a few more of arguments made in support of the notion that gambling and investing are not similar. Again, I think you’ll find that the two practices share more in common than many would like to admit.

Mathematical Expectations. Many investors go out of their way to avoid any association with gamblers. Sometimes, they’re making valid arguments. Sometimes, they’re claiming that “mathematical expectations” differentiate the two pursuits. That isn’t a compelling position.

Financial Mentor makes the argument:

Gambling and investing are both games of chance. Both involve probabilities where you put money at risk with the hope of a return, and both can make your hard earned savings vanish when you bet wrong.

So what is the difference between gambling and investing, and why should you care?

The difference boils down to one simple concept that sounds intimidating but is actually easy to understand – mathematical expectation.

That sounds good and it certainly puts investment in a positive light. The problem? It’s not really true.

The argument basically maintains that the difference between investment and gambling is the fact (and it is, admittedly, a fact) that a smart investor acting on the best possible information has a significant “edge” over the gambler.

That’s not a distinction between gambling and investing, though. It’s a distinction between different gambling options based on the odds.

Would you believe that blackjack is not a form of gambling because it offers a greater chance of winning than does a stay at the craps table? Of course not. Both are gambles. So was your latest stock purchase.

The fact that good investment has a much greater likelihood of creating better results doesn’t somehow divorce it from the world of gambling. It just makes it a better bet. And it remains a bet because even the wisest investor is at risk. If we’ve learned anything over the past few months, it’s the fact that even sane, conservative, well-planned investment strategies can stink the joint up like a bad beat on the river at a hold ’em table.

Time. Investing is long term. Gambling is short term. That’s a common position held by those who don’t think the two pursuits share a great deal in common. Matt Krantz outlined the argument in USA Today:

Investing is slower. You hope to double or triple your money, but over decades, not minutes or hours. This is possible by investing your money in companies that increase prices and profits steadily over time and return cash to investors.

The problems with this perspective?

First, it chooses to evaluate gambling as singular events and investments as a whole. Gamblers may opt to be in it for the “long haul”, making certain bets or engaging in certain behaviors over an extended time.

Second, it wrongly argues that investors are only interested in long positions. How long do you have to hold a stock to qualify as an investor, we might wonder.

Third, the time distinction is arbitrary. It doesn’t address the core motivations and mathematical underpinnings of either gambling or investment. It’s a straw grasp, trying to force a distinction artificially where none really exists.

Luck vs. Skill. This is probably the most common (and most self-serving) arguments investors offer as proof that they’re not gamblers. Don Luskin echoes the common sentiment in Capitalism Magazine:

The central idea that separates gambling from serious investing or trading can be discovered in the old saying, “I’d rather be lucky than smart.” The essential distinction is that gambling isn’t smart, and depends entirely on being lucky — while investing depends on being smart (but being lucky never hurts).

Luskin concedes that luck has some role in investment outcomes, but he still maintains that the dividing line is the “fact” that gambling is an inherently luck-based activity.

That represents a serious misunderstanding of gambling. Sure, there are those who slide a twenty into a slot machine and hope for the best. Those people are operating from a purely luck-based perspective. But what about the poker player who’s honed her skills for decades? What about the sports bettor or race handicapper that studies events, just waiting for the right opportunity to make a move? Hey, we can even toss in the weekend blackjack player who took the time to learn basic strategy.

These gamblers are not operating purely from a luck-based model. Yes, luck will play a role in their success, but luck can make the difference between a windfall and whether that hurricane barely misses the housing development into which you just sunk $150K, too.

The arguments trying to separate gambling from investing are usually rather superficial. They look for ways to distinguish the two for the sake of convenience, rather than based on the actual decision making involved shared in both processes.

HOWEVER… And you’ll notice that was capitalized…

Investing is probably the best possible form of gambling… We’ll discuss why tomorrow.

Advertiser DisclosureAdvertising Disclosure: Personal Finance Analyst has an advertising relationship with some of the offers included on this blog. However, the rankings, reviews, tools, and all other content are based on our objective analysis. For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. Personal Finance Analyst strives to keep its information accurate and up to date. The information in our reviews could sometimes be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products are presented without warranty.

| Free Republic Browse · Search | News/Activism Topics · Post Article |

Investor Guide ^ Tom Murcko

Posted on 09/28/2007 7:18:13 AM PDT by SirLinksalot

It is generally agreed that casinos should, in the public interest, be inaccessible and expensive. And perhaps the same is true of stock exchanges.' - John Maynard Keynes

--------------------------------------------------------

What is the difference between gambling and investing? In order to differentiate between the two, we should start by defining them. Comparisons are often made between the two activities, but I've never seen the terms explicitly defined. If you're sufficiently motivated, I encourage you to try to define the terms 'gambling' and 'investing' before you continue reading this essay... you may surprise yourself. (Go ahead, I'll wait here for you.)

What definitions did you come up with? Are investing and gambling mutually exclusive, or is there an area of overlap? And are the boundaries clearly delineated, or is there a gray area in the middle?

Let's see what the dictionary says. Here's what the Random House dictionary on my bookshelf says: 'Gamble: To play at any game of chance for stakes. To stake or risk money, or anything of value, on the outcome of something involving chance.' 'Invest: To put money to use, by purchase or expenditure, in something offering profitable returns.' Both seem reasonable upon cursory review, but a closer look reveals that they're not terribly helpful. The definition for gambling could apply just as well to investing, and vice-versa.

The Dictionary.com web site says:

'Gamble:To bet on an uncertain outcome, as of a contest. To take a risk in the hope of gaining an advantage or a benefit.'

'Invest: To commit money or capital in order to gain a financial return.'

Again, the distinction isn't clear. In investing, are you not betting on an uncertain outcome? Are you not taking a risk in the hope of gaining an advantage or benefit? In gambling, are you not committing money? Are you not doing it in order to gain a financial return?

Beyond the Dictionary

OK, so the dictionary definitions aren't very useful. Perhaps if we examine some of the ways in which gambling and investing are generally perceived to differ, we might be able to build definitions from those characteristics.

Perceived distinguishing characteristic: Investing is a good thing, gambling is a bad thing.

I think it would be hard to argue with the claim that investing is, on the balance, a good thing. Investing is widely regarded as the engine that drives capitalism. It tends to put money in the hands of those with the most promising and productive uses for it, and drives the economy gradually upward. Investors aren't merely betting on which companies will succeed, they're providing the capital those companies need to accomplish their goals. The U.S.'s leadership position in technology is largely due to investments by venture capital firms, angel investors and technophilic individual investors. Similarly, you can change the world in a small way by investing in companies you believe in, such as socially or environmentally conscious firms and mutual funds, or biotech companies that are working on diseases that might affect you or someone close to you.

Gambling, on the other hand, is not so clearly making a positive contribution. Gambling does tend to help local economies, but also usually brings with it well-documented unpleasant side effects. I'll leave it up to the reader to decide whether gambling is, on the balance, a plus or a minus. Looking to the financial markets, one could make the case that people who gamble in this realm do serve a function, by adding to the market's depth, liquidity, transparency, and efficiency. But that's of relatively minor value, and those gamblers probably capture most of that value for themselves. On the other hand, they often increase the volatility of the markets, which is on the balance usually a negative (although it does afford savvy investors opportunities for larger profits). As Warren Buffett has said, 'Wall Street likes to characterize the proliferation of frenzied financial games as a sophisticated, prosocial activity, facilitating the fine-tuning of a complex economy. But the truth is otherwise: Short-term transactions frequently act as an invisible foot, kicking society in the shins.'

The questions of whether gambling is morally wrong and how strictly it should be regulated are important but are well beyond the scope of this essay, and so I'll mention them only in passing. Governments generally frown on gambling (unless, of course, they're getting the lion's share of the profits, such as with state lotteries). Many religions frown on gambling (but they don't seem to mind church bingo). I have no problem with a person being morally opposed to gambling, as long as that person knows exactly what he/she means by 'gambling'.

I should hasten to add that not all types of investing are productive. Buying and holding results in a positive contribution to the economy, but buying and selling quickly, the way day traders do, results in no net contribution. For the purposes of the current investigation, we could either reclassify investing-type activities that aren't productive as gambling, or we could consider these to be exceptions to the rule. I lean toward the latter interpretation.

Perceived distinguishing characteristic: In investing, the odds are in your favor; in gambling, the odds are against you.

Peter Lynch has said that 'An investment is simply a gamble in which you've managed to tilt the odds in your favor.' But that position is too simplistic. There are plenty of investments where the odds are against you: futures, options, and commodities trading (where you get hurt on commissions and the bid/ask spread), frequent stock trading (for the same reason), and selling short (since the market goes up rather than down in the long run), to name just a few examples. Similarly, while for most types of gambling the odds are against you, it is possible for the odds to be in your favor. I spent one summer during college working in Arizona, and I drove up to Nevada most weekends to play blackjack. By counting cards, I was able to obtain a small but predictable advantage over the house, about 1.5% per betting unit on average. (I haven't returned since then, for several reasons: it's not intellectually challenging; while card counting is not illegal, Vegas casinos can make you leave if they suspect you of doing it; and I've found it easier and more enjoyable to make money in stocks than in blackjack.) Expert poker players can also make money at casinos, because their competition is other players rather than the house, and as long as the house takes its cut it doesn't care how the rest of the money is redistributed among the players.

There are additional problems with this attempted characterization of gambling as a losing bet and investing as a winning bet. It implies that a given activity switches from gambling to investing (or vice versa) as soon as the odds swing past the breakeven point. Similarly, if two players are participating in an activity in which one has an advantage over the other, it would mean that one person is gambling and the other is investing. That would imply that institutions which get in on IPOs at the offering price would be investors, and the little folks that those institutions immediately flip the shares to for a profit would be gamblers. Furthermore, while it's possible to calculate exact odds for some casino games, this is rarely the case on Wall Street. How can you know for sure whether the odds are for or against you if you decide to buy a particular stock today?

What about venture capital investments, you say? Aren't the odds stacked against them? Yes, the majority of venture capital investments result in loss, often a total loss of the amount invested. However, venture funds typically yield higher returns than stocks because a small percentage of the firm's investments are home runs, more than making up for complete losses on other investments. So while venture capital might seem like gambling in that the odds are against the VC firms on any given bet, on average the expected payoff is positive, so the odds in the long run are actually in their favor.

Perceived distinguishing characteristic: Gambling can be addictive and destructive, but investing can't.

Compulsive gambling has been correctly identified as a problem, and organizations like Gamblers Anonymous are helping people cope with the problem. No similar problem is generally thought to exist in investing. There is no Investors Anonymous, and no one talks about compulsive investors. But while there isn't yet widespread acknowledgement of investing addiction, there will be soon. Marvin Steinberg, executive director of the Connecticut Council on Compulsive Gambling, recently said this about investing addiction: 'We don't know the true extent of the problem because hardly anyone identifies it as a gambling problem -- they see it as a 'financial problem' or an 'investing problem.' ' Many online investors who claim to be buy-and-hold investors check their portfolios on a daily or hourly basis, and jump in and out of stocks more often than they realize. Active trading can be expensive, both in terms of the commissions and bid/ask spreads and in terms of emotional fatigue. Also, some people invest more aggressively than they should, which is virtually identical to gamblers who bet more money than they can afford to lose. This page provides a list of questions to help a person determine if he/she might be a compulsive gambler. Replace the word 'gambler' with 'investor' for each question and the questionnaire is equally useful, but for a different purpose.

Perceived distinguishing characteristic: Gambling is entertainment, investing is business.

As Brad Hill has said, 'Global financial markets represent the greatest spectator sport humanity has ever devised. It has planetary reach, a multitude of local competitive arenas, volumes of statistics, star players, and -- best of all -- anyone can move between the domains of observer and participant, fan and player. If you squint just right, the steadfast newscasters of CNBC appear to be play-by-play announcers, calling the game for U.S. fans. And do financial sections of newspapers differ from sports sections in their presentation of story, data, and personality? Not essentially.' While the 'gambling as entertainment, investing as business' dichotomy may have been clear in the past, the line is being blurred. The internet has enabled online brokerages and other financial web sites to revolutionize retail investing, which on the balance is a tremendous benefit to both individual investors and the economy in general. However, the widespread accessibility of cheap online trades has also attracted some people who enjoy betting and view online trading as a new form of entertainment. The major factors accelerating this trend are that gambling is strictly regulated and not ubiquitous, and that the odds are usually better in investing than in gambling.

Chris Anderson, executive director of the Illinois Council on Problem and Compulsive Gambling, has said that compulsive gambling isn't really about making money, it's about 'action', and the lure of the big win. While I'm not a neuroscientist, I suspect that the chemical changes that occur in the brains of compulsive gamblers and compulsive day traders are similar, since they're both riding on the same emotional roller coaster of wins and losses. Similarly, while some people who invest in high-tech stocks do it for the potential returns, others do it because of the rush they get from the tremendous volatility. It feels right to classify the latter group as gamblers rather than investors.

I don't mean to imply that I think it's acceptable to gamble for entertainment but not to invest for entertainment. I think both are equally acceptable, provided the person enjoys the activity (as opposed to feeling a compulsion to participate) and provided the person uses only money he/she can afford to lose. But I'm probably not the best person to make a judgment on this question, because I've never found either gambling or investing to be entertaining... my goal has always been value creation rather than enjoyment, and I place bets only where the odds are most heavily in my favor, not where I expect to find the most excitement.

Perceived distinguishing characteristic: Investing is saving for specific goals, such as retirement, while gambling isn't.

Many people regard investing as a planned strategy of wealth-building for specific future goals. And this is certainly true of some types of investing. But this is largely a by-product of having the odds in one's favor. If you have the edge (whether in blackjack or in equities), time and the laws of probability are a powerful combination. Gambling would work just as well as investing for financial event planning if gambling games were in your favor.

Perceived distinguishing characteristic: Investors are risk-averse, while gamblers are risk-seekers.

Risk-taking is intrinsic to both gambling and investing. There are a few investments that don't entail risk, such as fixed annuities and government bonds held to maturity, but even those have inflation risk. The major difference between the two groups seems to be the participant's relative willingness to accept risk. Investors tend to avoid risk unless adequately compensated for taking it, but gamblers don't. To put it another way, investors take only the risks they should take, while gamblers also take some risks they shouldn't take. Would you rather have or a 50/50 chance at ? If you take the , you're an investor. If you go for all or nothing, you're a gambler. Would you rather put your money under your mattress or in an extremely volatile stock that could go bankrupt or could double in value? The question is slightly different, but the answer is equally instructive. If you expect to double your money quickly, whatever you're doing is probably gambling, even if it happens on Wall Street rather than in Las Vegas.

However, this characterization of gamblers as risk-takers applies only to non-professional gamblers, people who visit Atlantic City for a weekend for entertainment purposes. Professional gamblers who have managed to tip the odds in their favor behave more like investors, shying away from risk unless the reward is sufficient to justify taking the chance. In fact, one could make the argument that investors generally take on more risk than professional gamblers, because of the uncertainly inherent in the financial markets. As I mentioned before, it's difficult for investors to calculate how much of an advantage they have, but the odds of a given gambling strategy can be known either precisely or at least approximately.

Perceived distinguishing characteristic: Investing is a continuous process; gambling is an immediate event or series of events.

This rule does seem to hold in most cases. Investing is a continuous process of deployment of capital in search of continually increasing net worth. As a result, delayed gratification is implied. Gambling is a specific act or series of acts, centered around immediate gratification. In this respect, day trading resembles gambling: the participant gets in, the price moves up or down, and he/she gets out, usually in a matter of minutes. The same could be said of buying with the belief that a stock is about to jump, or buying IPO shares with the intention of flipping them in a few hours or days, or buying options which are close to expiration. On the other hand, buying in the belief that a stock's price will eventually reflect its value, with the plan of holding as long as it takes for this to happen, is more like investing.

Perceived distinguishing characteristic: Investing is the ownership of something tangible; gambling isn't.

The latter half of the statement is certainly true, but the former half is only sometimes true. Some investments involve the ownership of something tangible, but many don't. For example, derivatives are investments 'derived' from other investments. An option is a derivative that gives the owner the right to buy or sell a specific amount of a given security at a specified price during a specified period of time. Options are generally classified as investing rather than gambling, and rightly so, but they do not represent ownership of anything tangible. However, when you realize that an option is essentially a bet that a given security will or won't be above a certain price on or by a certain date, it starts to feel more like gambling than investing.

An even more strict definition of investing would require that it involves the purchase of an asset which either produces a stream of income or can be made to produce a stream of income. But this definition would eliminate such assets as collectibles, stamps, art, and gold, which have no intrinsic value. I don't think it makes sense to exclude them simply on this basis. We might choose not to consider them investments because of their poor long-term performance, but we shouldn't choose not to consider them investments simply because they won't ever produce a stream of income.

Perceived distinguishing characteristic: Investing is based on skill and requires the use of a system based on research, while gambling is based on luck and emotions.

A lot of so-called investors don't do nearly as much research as they should. Many buy on tips or rumors, or based on some analyst's price target, without doing their own exhaustive research. It feels right to call such behavior gambling. Similarly, investors who are making decisions based on emotions (especially greed and fear), rather than remaining emotionally detached and sticking with their strategy, are to some extent gambling.

On the other side of the coin, some gamblers do serious research, often paying hundreds of dollars a month for real time data on what the current lines are (for example, on http://www.scoresandodds.com or http://www.vegasinsider.com). Professional sports investors devote 12 hours a day, every day, to handicapping sports. They read dozens of newspapers, subscribe to line services, maintain inside contacts, and have years of experience, usually on both sides of the betting counter. These professionals keep their emotions away from the decision-making process. Once they have a system that works for them, they don't second-guess it, focusing on long-term profits instead of day-to-day performance. Also, they concentrate on the areas in which they achieve maximum results. Many professionals bet only on one sport, which bears more than a superficial resemblance to Warren Buffett's idea of staying within one's 'circle of competence'.

While investing and gambling probably initially appear to be worlds apart, the above attempts at differentiation revealed that the actual differences are smaller than the perceived differences, and that there is a significant gray area in the middle. Based on the above characterizations, it is clear that the appropriate classification isn't wholly dependent on the activity, but also on the way in which the activity is conducted. There's a big difference between buying a stock after thoroughly researching it and buying a stock by hitting it on a dartboard. This is true even if the same stock happens to be chosen. Similarly, there's a big difference between buying exotic derivatives to hedge against an existing risk or position and buying the same derivatives because you saw a web site touting them. As a final example, there's a big difference between buying a government bond in order to collect the interest it earns and buying the same bond in the belief that interest rates are about to drop and the bond's value will skyrocket.

One interesting thing to note is the pattern of exceptions to the attempted characterizations. Most of the exceptions were people who were doing investing-related things but weren't behaving like investors, or people who were doing gambling-related things but weren't behaving like gamblers. Of the four groups, recreational investors, professional investors, recreational gamblers, professional gamblers, there are more similarities between the two recreational groups and between the two professional groups than between the two investing groups and between the two gambling groups. Specifically, those who use a rigorous system, do research, tilt the odds in their favor, treat it as a business rather than as entertainment, avoid addiction, and keep their emotions in check tend to behaving like investors, and those who don't tend to be behaving like gamblers. It might not be such a stretch to call professional gamblers 'investors' and recreational investors 'gamblers'.

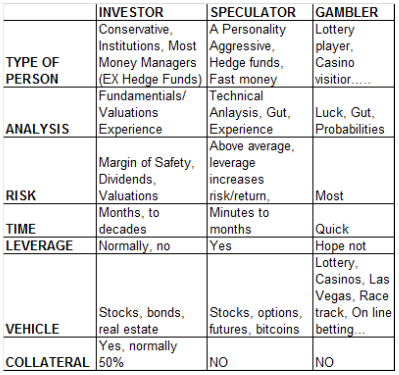

A Third Option: Speculating

Another possibility is that the two terms 'gambling' and 'investing' aren't sufficient to cover the entire range of activities under consideration. A third term, 'speculating', is often used to straddle the two, specifically to handle activities that would ordinarily be considered investing but are done in a way that make them feel more like gambling.

In The General Theory of Employment, Interest, and Money, John Maynard Keynes defined speculation as 'the activity of forecasting the psychology of the market', and speculative motive as 'the object of securing profit from knowing better than the market with the future will bring.' Many people consider billionaire George Soros to be an investor, but he prefers the term speculator. In fact, he has said that 'an investment is a speculation that has gone wrong.' What he means by this is that, among speculators, an 'investment' is the name they give to a speculation that didn't work out the way they expected and that left them stuck with a position they hope will improve with time. Soros and other speculators make their predictions partially based on market psychology, and in this respect their behavior fits perfectly with the Keynes' definition of speculation. But there is much more to speculating than just interpreting market psychology, and this definition isn't sufficiently distinct from the ones we formulated for gambling and investing in the above section.

According to the dictionary on my bookshelf, speculation is 'the engagement in business transactions involving considerable risk for the chance of large gains.' By this definition, the entire distinction rests on the degree of risk and size of potential gains. In support of this definition, bond rating agencies commonly use the term 'speculative' to refer to high-risk bonds (those rated below BBB by S&P or Baa by Moody's).

In their book Investments, Zvi Bodie, Alex Kane, and Alan Marcus argue that 'a gamble is the assumption of risk for no purpose but enjoyment of the risk itself, whereas speculation is undertaken in spite of the risk involved because one perceives a favorable risk-return trade-off.' But this is too simplistic... no one would play casino games if the only possible outcomes were either breaking even or losing; the rush they experience comes from the possibility of winning and not merely from the taking of risk. They continue: 'To turn a gamble into a speculative prospect requires an adequate risk premium for compensation to risk-averse investors for the risks that they bear. Hence risk aversion and speculation are not inconsistent.' This part I agree with. In fact, whether they realize it or not, their definition reclassifies gambling as speculation when the odds can be sufficiently tipped in the player's favor, such as in professional blackjack or poker, which fits in nicely with argument made in the previous section.

Zvi Bodie et al appear to be saying that in order to be speculating rather than gambling, the person must not take greater risks than are justified by the potential reward. Others say that in order to be speculating rather than investing the person must be taking greater risks than are justified by the potential reward. For example, in Benjamin Graham and David Dodd's classic Security Analysis, they argue that 'an investment operation is one which upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.' Both positions are defensible. But perhaps a better interpretation would rest on the realization that different investors have different tolerances for risk. Perhaps speculators are those who are risk-neutral, while gamblers are risk-seekers and investors are risk-averse. While adding the term 'speculation' to the mix might have some value, it probably adds more confusion than clarification, so I prefer to leave it out and focus on just 'gambling' and 'investing'.

Conclusions

So what's my resolution to this definition conundrum? Well, the purpose of words is to communicate concepts. So it doesn't really matter what definitions you use, as long as you and the person(s) you're communicating with are clear about what is meant by those words. And even more importantly, as long as you know what you're doing, investing or gambling, before you do it.

But with that said, it would be beneficial if everyone could agree on what the terms mean, so we don't need to make our definitions explicit every time we want to use them. To this end, I offer the following definitions, which are built from the various characterizations in the above section:

Investing - 'Any activity in which money is put at risk for the purpose of making a profit, and which is characterized by some or most of the following (in approximately descending order of importance): sufficient research has been conducted; the odds are favorable; the behavior is risk-averse; a systematic approach is being taken; emotions such as greed and fear play no role; the activity is ongoing and done as part of a long-term plan; the activity is not motivated solely by entertainment or compulsion; ownership of something tangible is involved; a net positive economic effect results.'

Gambling - 'Any activity in which money is put at risk for the purpose of making a profit, and which is characterized by some or most of the following (in approximately descending order of importance): little or no research has been conducted; the odds are unfavorable; the behavior is risk-seeking; an unsystematic approach is being taken; emotions such as greed and fear play a role; the activity is a discrete event or series of discrete events not done as part of a long-term plan; the activity is significantly motivated by entertainment or compulsion; ownership of something tangible is not involved; no net economic effect results.'

Speculating -I would prefer to avoid this term entirely, but if necessary I would define it as 'Investing or gambling characterized by a high degree of risk and a high potential for reward.'

Are you disappointed that I didn't crystallize the essence of gambling and investing into a single distinguishing feature? Did I merely sidestep the ambiguity, and sweep the gray areas and the important exceptions under the rug? I don't think so. The taxonomy doesn't have to be completely distinct in order to be useful, nor does it need to be just a single feature. And just because some of the characterizations had exceptions doesn't mean they should be thrown out entirely. Nearly everyone agrees that the concept of 'chair' is a useful one, even though it's difficult to define exactly what the necessary and sufficient characteristics of a chair are.

Why Does it Matter?

Lawmakers and regulatory bodies need to be clear on what the terms mean, so they understand the scope of their legislation and regulation, regarding prohibited behavior, adequate disclosure, participant protection and similar issues. In general, I'm in favor of less regulation and more disclosure for both activities described as gambling and those described as investing, but I'm no expert on the subject and a thorough discussion is beyond the scope of this essay.

Everyone needs to realize how easy the internet makes it to gamble under the guise of investing. When people use generic terms without ever specifying what they mean, it's easy for those terms to gradually change in meaning, and I think that's exactly what the internet is causing to happen. I don't mean to imply that the internet's democratization of investing is a bad thing. In fact, I think it's the one of the most important developments in the history of investing. My hope in pointing this out is to awaken those individuals who are acting like gamblers but who think they're acting like investors.

Investing addiction is as serious as gambling addiction, and should be treated as such. If more people start to view buying and selling stocks online as a way to get the betting rush that previously required a trip to a casino, is there any reason to think the same negative consequences that follow gambling won't also follow investing? Perhaps investing addiction is not getting the attention it deserves because most people are attaching to it all the positive connotations of investing and none of the negative connotations of gambling.

Those who have ethical problems or religious issues with gambling (or even investing) owe it to themselves to figure out exactly what they object to and why. As I mentioned, I have no such ethical problems with either gambling or investing, but again, this discussion is beyond the scope of this essay.

I'll leave it to Benjamin Graham to further emphasize why such clarity is essential. In The Intelligent Investor he said: 'The distinction between investment and speculation in common stocks has always been a useful one and its disappearance is a cause for concern. We have often said that Wall Street as an institution would be well advised to reinstate this distinction and to emphasize it in all dealings with the public. Otherwise the stock exchanges may some day be blamed for heavy speculative losses, which those who suffered them had not been properly warned against.' He continues: 'Outright speculation is neither illegal, immoral, nor (for most people) fattening to the pocketbook . . . There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are: (1) speculating when you think you are investing; (2) speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it; and (3) risking more money in speculation than you can afford to lose.' I agree completely, and I suspect that his use of the term 'speculating' is very similar to this essay's use of the term 'gambling'.

Special Disclaimer

1. This essay is not meant to condone gambling, or to suggest that you cash out your portfolio and become a professional blackjack or poker player. Those are tough ways to make money, and were mentioned primarily for illustrative purposes.

2. We recommend that you get assistance from a professional before doing anything you don't know how to do.

3. Some of these activities, especially those considered gambling, might not be legal in certain places. Even if you find bets for which the odds are in your favor, we encourage you to make sure your chosen activity is legal before participating.

KEYWORDS:gambling; investingNavigation: use the links below to view more comments.

first1-20

, 21-40, 41-60, 61-80, 81-86nextlast

, 21-40, 41-60, 61-80, 81-86nextlast

Nothing. Believe me, both are crapshoots.

I was looking through the old records of the country Baptist church that my grandparents attended. In a monthly deacons’ meeting in 1893, my grandfather raised the question whether trading in cotton futures was a suitable activity for church members. A committee was appointed to investigate. The following month the committee reported that “futures trading was gambling of the worst and lowest sort”.

“You guys are like a couple of Bookies.” - Billy Ray Valentine

aka Eddie Murphy - Trading Places

ping

ping

Yes, but the question of legality aside, is there an INTRINSIC difference between the two ? That is the question this article tries to answer.

Otherwise all we have is this -- it is legal or illegal because some elected government bureaucrat says it is.

I didn't see the movie. Who was he refering to ?

“If shit was worth something, poor people would be born wo/

assholes.” BR Valentine (Trading Places)

Buying IBM and enrolling in the dividend reinvestment plan w/ the hope

that it will be higher in 30 yrs is investing.

Buying IBM w/ the hope that it will be higher tomorrow is gambling.

See the difference?

MV

What the invested money supports

By Oscar Brand paraphrased

My Father makes book on the horses.

My mother sells second hand gin.

Look how the money rolls in.

By comparison, gambling nearly always generates a negative return. The house wins in the long run.

So, in general, investors gain money and gamblers lose it. It really is that simple.

Larry Stovall said selling a soybean contract short is worth two

yrs at the Harvard B school. Or was it Sam Stovall?

Maybe your ancestor’s church should have been dealing in soybeans and

not cotton.

MV

Difference Between Gambling Investment And Speculation

One is a zero sum game, the other isn’t.

Poker is a game of American Capitalism at its purest form. A multitude of races, cultures, creeds, and religions all gather around a felt table in order to viciously take money out of their peers’ pocket. Every single poker player at the table KNOWS that he is better than the guy sitting next to him. They are there for the sole reason of taking that sucker’s money. It’s a kind of Poker Darwinism; only the smartest survive with their bankrolls intact. There is no health care for the professional poker player, nor welfare. It is one of the only legal tests of true fortitude and grit left in this world. It is mano y mano combat.

first1-20, 21-40, 41-60, 61-80, 81-86nextlast

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.

| Free Republic Browse · Search | News/Activism Topics · Post Article |