Online Gambling Tax Ireland

There is a big difference in taxation in terms of trading and recreational gambling. Let’s discuss if your gambling rewards are taxable in Ireland.

It’s a given that your winnings from lotteries and sports betting are not subject to Ireland’s capital gains tax. It’s good news for gambling aficionados and casino enthusiasts. While most gambling game winnings aren’t taxable, it’s important to note that the income tax approach is not crystal clear when a punter is regarded as a trader or a simple recreational gambler. So how would you know if you are assuming a trader role or just a recreational gambler?

Just like land-based casinos, online casinos can also lead to gambling addiction, so always play safe and stay gamble aware. The majority of players across the globe have fun playing online casinos. Opting for online gambling in Ireland is an obvious choice as most people don’t have access to a land-based casino in the country. Barry O'Halloran Paschal Donohoe said that it was “timely” to increase the current 1 per cent rate levied on all bets placed in the Republic of Ireland to 2 per cent for all bookmakers.

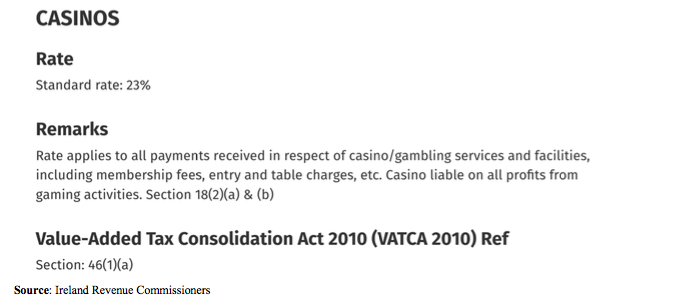

Gaming operators who are licensed overseas but accept Irish customers should also be aware that their Irish revenues may be subject to value added tax (VAT) under Directive 2006/112/EC on the common system of value added tax and its implementing regulations (282/2011/EU). EGaming services are taxable in Ireland at a rate of 23% on a point of. The Taxation of Betting in Ireland Betting tax revenue in Ireland has declined over the years as the rate of tax has been reduced. At one time it was 20% on turnover but has been reduced progressively to 10%, then 5%, then 2% and finally to the current 1% in 2006.

What’s the Difference Between a Recreational Gambler and a Trader?

Online Gambling Tax Ireland 2020

Online Gambling Tax Ireland Uk

Investing in gambling is a very subjective notion. It’s a given that gambling depends on pure luck and it doesn’t require any skills to win. There is no really a rational prospect of gaining profit from a gambling activity, hence, it can’t be considered as a trade per se. The ironic topic would be betting is systematic and organized in such way that the profits are the reward of the bettor’s wager options. The proceeds are deemed as income from a taxable trade. Are you confused already?

Will Spread Betting Winnings be Taxable?

It’s a conflict that the gambling industry is debating. There’s not objective method to determine if a gambling activity as a trade per se. The Ireland Revenue Commissioners are reviewing every case based on actual facts and situations. The objective approach would only be seen if a person is regularly engaging in gambling activities. This person isn’t a recreation gambler since he is wagering to create profit from a wagered amount of money. It’s considered a trader’s approach.

Online Gambling Tax Ireland 2019

According to Galway Independent, these are the factors to consider if a person is trader:

- The scale of the activity i.e. the amount and frequency of the transactions

- The background of the individual i.e. if they are skilled or qualified in a particular area

- Does the bettor engage in the activity principally for profit or pleasure

- Does the bettor run a business ancillary to their gambling activities

Are Winnings Taxable in Other Countries?

Bettors in the United States who are fortunate to win a big among of more than $5,000 in a lottery will be subjected to 30% withholding tax. For instance, if you win a whopping $100,000 jackpot, you only receive a net total of $70,000.

The Internal Revenue Service will claim the $30,000 to settle your tax liability. Good news for table games enthusiasts, your winnings on roulette, blackjack, and baccarat aren’t taxable. Gambling losses up to the total amount of winning can be offset for tax purposes as well.

Gambling Winnings Taxation are Subjective

Gambling activities in Ireland aren’t all subjective to income tax. Recreational gamblers won’t feel the effects of gambling taxation. The idea though is that it is still subjective whether a person is a trader or a recreational gambler.

For instance, a trader can wager $1,000 daily per week and a recreational gambler will wager $7,000 per week; it’s the same amount but the frequency is different but the objective is the same which is to gain profit. Right? Still confused? Let the Irish gambling regulators take care of this issue and enjoy the games.

According to RTE, Taoiseach Brian Cowen recently announced that the Government will be taxing online betting of all forms.

Legislation is to be brought in which will see the introduction of licenses for overseas betting providers in order for them to be permitted to sell their products in Ireland.

Cowen said, 'This will have the additional benefit of facilitating the extension of the tax regime for the betting industry to all those providing online and telephone betting and so underpin funding for the racing industry.

“Such betting must be brought within the tax net, not just because it will increase revenue, but also because it will mean that those currently not contributing to securing the future of important indigenous industries will now make that contribution.”

Last year, Minister for Sport Martin Cullen threatened to ban online poker and gambling in Ireland if bookmakers did not pay more money to the Exchequer for the Horse and Greyhound Racing Fund. This tax alternative could now be seen by some as the lesser of two evils.